Conference white papers are available for your use and information.

If you need more information please contact us.

Good businesses are full of excellent processes; product development, customer order fulfilment, production, shipping and distribution and in most cases these processes also have a budget, resources and people performing and improving the processes.

However, when it comes to Demand Management, generally we don’t see mature processes in place instead ‘ad hoc’ people, usually the salesman, sucking their thumbs raw at month end and trying to satisfy the boss with a forecast for the next month, or if we are lucky, two months! There is generally no budget, few resources and nobody dedicated to ensure that this important task takes place, and more importantly, is improved.

Let’s face it, if you don’t have a reasonable idea of your forecasted demand, how can the planners and factory make a credible job of satisfying the true demand?

So, let’s see what needs to be done to improve the situation and achieve a reasonable forecast and then a consensus demand plan that can used to drive the planning systems in your business.

The ultimate object of the Consensus Demand Planning process is to provide the business with the input to drive the three levels of planning; Strategic Planning, Executive Sales and Operations Planning and Master Production Scheduling. These three demand plans need to be developed from the same data, support each other and be a consensus of those with insight into the companies demand. They must not be developed separately with different groups of people or be one person or one groups thoughts on what the future holds.

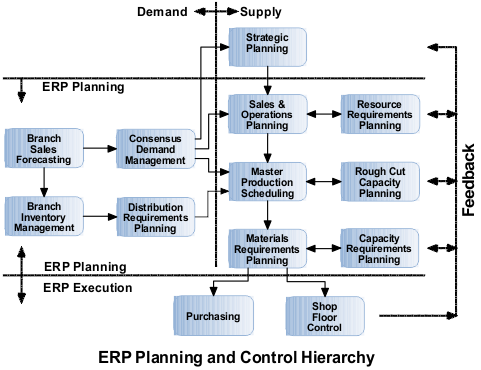

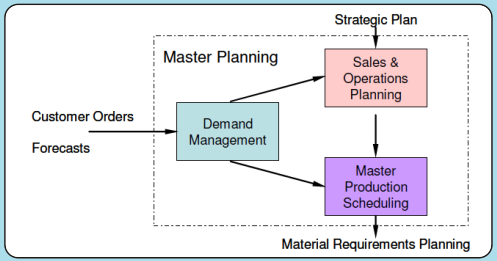

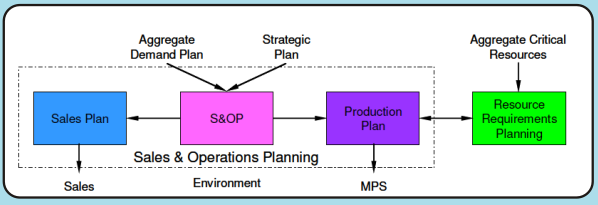

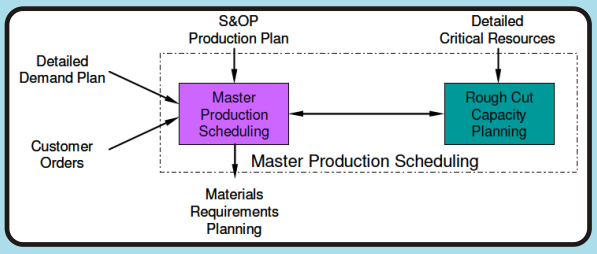

If we look at the ERP planning hierarchy below you will see that the chart is divided vertically in two. The left hand side is the demand management side and the right hand side is the supply management side. Supply management can’t happen until the demand has been reasonably determined. When we look at the supply side, you will see, apart from strategic planning, there are three levels of planning, Executive Sales and Operations Planning (S&OP), Master Production Scheduling (MPS) and Materials Requirements Planning (MRP) . These plans drive each other and ultimately support each other. Your demand management process needs to supply input to these processes, in total to the strategic planning process, in product family aggregate to the executive S&OP process and in finished product detail to the Master Production Scheduler. The MRP process is then driven by the MPS and not customer orders and forecasts, which happens in many businesses. But that is another issue, for another day!

The S&OP and MPS plans need to be updated on a monthly basis; therefore your demand management process also needs to be carried out on a monthly basis. And, because no planning can take place until the consensus demand plan has been agreed it therefore has to be carried out as soon as possible after month end, preferably in the first week, this will enable the Executive S&OP process to take place during the second week of the month.

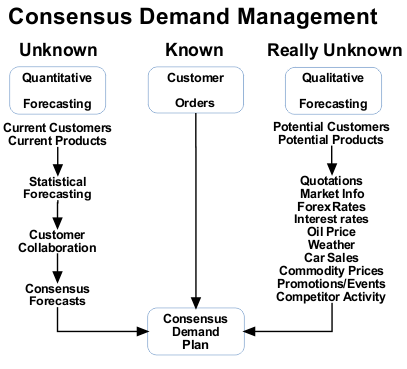

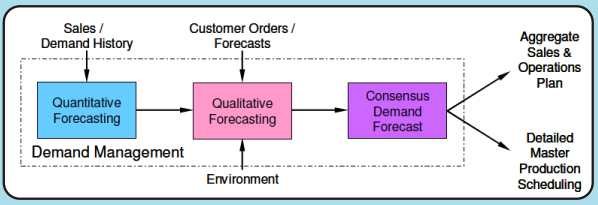

Looking at the chart below, demand management can be broken down into 3 parts, namely, the known, the unknown and the really unknown. Let’s look at each of these separately.

The known is the easiest part as this is basically your customer order book. You know exactly what is required and when. Unfortunately, in most businesses these orders only extend to the next few days or weeks, if you are lucky. We just need to make sure that these orders are entered onto your system as soon as possible such that they can consume the forecast, if normal demand, or get added to the forecast if they are abnormal demand. Normal demand orders are those that you were expecting and were forecasted, abnormal demand orders are those that you weren’t expecting and came out of the blue and should therefore be added to the demand.

Things start getting a bit more difficult in this area. Here we have to forecast current customers and current products. This is where we use quantitative statistical forecasting to assist us in looking for trends, patterns and seasonality and projecting them in the future to give us some indication of what the future might hold. It is at this point that most salesman get a spreadsheet of numbers and they are ask to project the future and generally the best that is achieved is a simple moving average out into future. Simple moving averages are fine for stable, non trended, non seasonal products, and I would suggest that you probably don’t have too many of those types of product. Hopefully, your product sales are growing and more often than not demand is not constant on a monthly basis and exhibits some form of seasonality.

Let’s look at some real data here and the results you would get using a simple moving average and then doing the job properly.

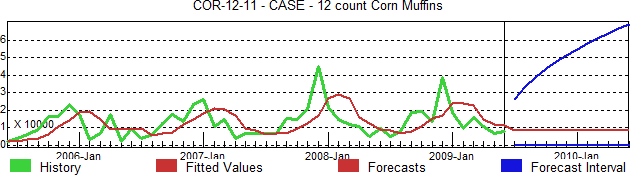

In the above graph, the green line to left is the sales history for a product going back about 4 years, the level red line to the right is a 3 month simple moving average forecast. The blue lines to the right indicate the confidence the system has in that forecast and basically represent +/- 3 standard deviations from the projected forecast. The red line to the left trying to following the green sales history, known as the fitted value, is what the system would have forecast using a 3 month moving average. Moving averages always lag the actual demand which can be clearly seen in the diagram. The Mean Absolute Percentage Error (MAPE) for this example was calculated at 41%.

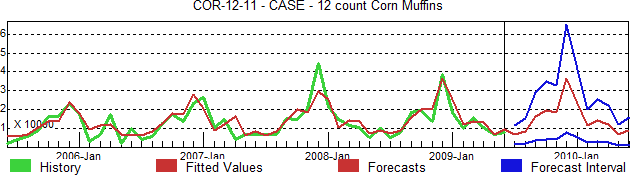

Now, if we ask the expert system to look for an algorithm that gives us the least errors we get the result in the following graph. In this case the system has chosen multiplicative Winter’s method and the MAPE is now nearly 74%, a significant improvement is forecast accuracy, literally in seconds, just at the press of a button, with no hassle. Now you can see the forecast has picked up the seasonality of this product and the confidence in the forecast is greatly improved. In addition, the fitted value follows the seasonality of the sales history fairly closely.

Now all we have done so far is to look for patterns, trends and seasonality and project them into the future. But, we know the future is not a direct representation of the past, so we need to collaborate these forecasts. This means talking to your customers and getting the salesman to adjust the forecasts at the detail level. These adjusted forecasts will then be used by the demand management team, to generate the consensus demand plan.

Now for the difficult bit, the really unknown demand. This is where we try and determine the demand for new products and new customers as well as take into account business environmental factors that affect demand, over which you have no control.

If you have a new product/market development function, they will be required to supply information on new products and customers along with launch dates and expected sales. If you are preparing quotes for you current and prospective customers get sales and marketing to estimate the probabilities of obtaining that business and develop a way of including this in your demand plans.

All businesses work in an economic and business environment over which they have no control. Things like interest rates, car sales, the weather, Forex rates, the oil price, commodity prices, cost of power, recession and boom periods, major sporting events, etc, etc, etc, have effect on your demand and you really need to understand which of these affect your business and in what way. These effects would probably then be applied to our demand plans at the product family aggregate level to come up with a more realistic bigger picture demand plan.

When you generate a statistical forecast it is important that you use the demand history and not the sales history to project into the future. The sales history, you download from your ERP system, is a record of what you sold each month, which is not necessarily a record of what the true demand was. Let’s look at a few examples:-

So, taking all the above into account, it is important that you develop a demand history file that is used to forecast you products into the future, and that the latest sales history is appended to this file monthly and then ‘massaged’ into, as close as possible, the true demand for that month, before statistical forecasting can takes place.

In addition, make sure all dead products are removed from the demand file, you don’t want to waste forecasting effort on lines of old products that will never be sold again. If they are resurrected in the future they can always be added back into you demand history file.

Just a word on budgets, this term is banned in demand management. You can’t drive a business’s planning system on a static, out-of-date budget, unless your strategy is go out of business. The business has to be driven using a continuously update, improved, reasonable demand plan that reflects the current business environment, not what we thought might happen 9 to 15 months ago! Do not adjust your demand plans to match the budget, this crazy, but companies are forced to do this all too often! By all means, report budget against the current demand plans, and if you are way out find ways of improving your budgeting process by improving your demand management processes. After all, the budget should have been built from the consensus demand plans which are frozen at budgeting time.

What we see in many businesses is that they only forecast out a few weeks or months, this is insufficient if you what your ERP planning systems to function properly.

For strategic planning, in most businesses, you require a total demand plan, in Rands, tonnes, hectolitres, etc, going out to at least a 3 – 5 year planning horizon. If you are a chemical company, oil refinery, power generator, etc, you could be looking out maybe as far as 10 – 20 years.

For the Executive Sales and Operations Planning process, the horizon is determined by looking at how long it takes you to significantly change your capacity. For most businesses this will be about 2 years. You need to know if your current capacity is going to be insufficient to cater for the demand in two years time, so you can budget for new plant this year that can be purchase and installed in the following year. The demand plan for this process has to be aggregated up into production product families. At this level you are only planning product volumes through the plant.

At the Master Production Scheduling planning level you are planning the product mix. The main purpose here is to determine the anticipated build schedule out to the MPS planning horizon so we have sufficient time to purchase the required long lead time raw materials and components. If you are importing items with a +/- 3 month lead time, you will need an MPS planning horizon of about 6months, which include your manufacturing lead time, procurement lead time and a month or two look-ahead period for purchase order batching purposes.

So in summary then for this section, your consensus demand management process needs to provide input to the strategic planning process with the total demand out to 3 – 5 years, for the S&OP process in a production product family aggregate demand plan out to 2 years and a 6 month plan in finished product detail for the Master Production Scheduler.

The consensus demand management process can’t be carried out by a single person or function, the reason we call it a consensus demand plan is that several people and functions are involved, this team will then arrive at a consensus as to what the company can reasonably expect as far as demand is concerned.

In the past when the salesman got the forecast wrong we tended to go down a ‘beat’ him, or her, and hope they did a better job next time. Bearing in mind that the first rule of forecasting is that it will be wrong, the salesman were on a hiding to nothing and obviously were not seriously keen to partake in such a process. Now when the consensus demand plan is wrong, and it will be, we try and determine why we got it wrong, file that information away in our knowledge bank and try and improve the process for the next month.

So, who should be included on this demand team? Certainly there needs to be representation from sales and marketing. New product development should also be there if the business is growing significantly in both products and markets. The master production scheduler should also be in attendance, the more they understand about the demand the better they will be able to plan the supply. Plus anybody else in the business that has insight into what drives or affects the demand on the business. The financial manager’s attendance could be useful if Forex rates or commodity prices affect your business significantly. And, lastly don’t rule out an outside consultant that may have a better understanding of the markets in which you operate than you do.

Ultimately, this whole process should be pulled together and managed by a demand manger that reports to the sales and marketing department as they should ultimately own the consensus demand plan and be happy that it can be achieved.

We mentioned earlier that this process requires a budget, what do you include and how much will it be? Well, it is not going to cost a fortune, but some money and resources will be required.

The first thing you don’t do is go out and buy the most expensive demand management software you can find, the chances are it will never be implemented because it is too complex and you haven’t developed a process yet. You must learn to walk before you can run.

Certainly buy a simple statistical forecasting package, there are plenty around and they are relatively inexpensive. Learn how to use that first and get the best out of it before considering more sophisticated software that may provide you with some other benefits and functionality and there are some really good tools out there. So don’t buy the Ferrari before you have learned how to drive the VW golf properley!

When budget is available the next requirement is to employ a Demand Manager who will orchestrate, develop and most of all continuously improve this process. Look for somebody who has certified qualifications in this area of business, admittedly not easy to find. Otherwise, make sure they gain their qualifications whilst in your employ. Take a look at the qualifications offered by the Institute of Business Forecasting.

Some companies try to combine the demand and supply (MPS) manager positions. This is not good practice, the poor incumbent will not know on which side of the business he is operating at any one time, demand or supply, and will probably do a half hearted job on both sides of the fence. The requirements for both these functions are totally different and require different expertise.

So let’s put all the above together and suggest a demand management process that you can build in your business.

If you look at the flow chart below, the process starts with the Demand Manager, if you have one, or the person currently fulfilling that role. Their first job is to download the latest sales history and append the data to the demand history file. The latest data then needs to be adjusted to reflect the true demand or flagged as an event if one had taken place that month.

The demand manager would then input the latest demand data in to your statistical forecasting system and literally seconds later can save the output so the sales and marketing team can move into the next phase of the process, collaboration with the customer.

Most statistical forecasting systems will have the ability to adjust the forecasts in the system in collaboration with the customer. Now we all have limited time so we need to know where our time will yield the greatest benefit. Therefore, we should apply Pareto analysis and you should only collaborate on your forecast with regards to your top 20% of customers, or products, that provide 80% of your sales. So, armed with their laptops your salesman need to visit customers and talk demand and adjust the forecasts in real-time based on their customer comments.

These collaborated forecasts are then fed back to the demand manager and it is time to call the consensus demand team together.

The term supply chain management has only been in our vocabulary, and in the APICS body-of-knowledge, for about the last 12 – 15 years. Supply Chain Management is no quick fix to your companies 'ills' as we will see, it is a lot of hard, worthwhile, work by the whole company, not a few individuals.

Today it is not business as usual and if we expect a different result by doing the same old things we have done over the last quarter century, are going to be sadly disappointed. We need to take our companies tear them apart and rebuild them from the top, down and the bottom up.

If you are looking to, and who doesn’t want to:-

It isn’t going to be achieved by running your businesses as you have done for the past 30 years.

Whether we like it or not most of us are part of a global supply chain network and we need to learn the new rules if we want to successfully play the game. We must stop regarding our company in isolation, but as part of a supply chain that will only be successful if the end product, to which we contribute, is actually sold to a consumer. We see that there is a trend developing that integrated supply chains will compete with supply chains as opposed to the old thinking that companies compete against individual companies.

Supply chain management is considerably more than a handful of people in your organisation applying a few tools, it is going to be a company wide effort from, initially the top, and then down to the bottom.

Simply, Supply Chain Management is concerned with the uninterrupted stream of information flowing up the supply chain, pulling material continuously down the supply chain with the constant flow of money flowing back up the supply chain the replace the material. In addition, and this is likely to increase greatly in the future, the return of material back up the supply chain for re-use, re-manufacturing or recycling.

All material flows start with the earth, the ‘gatherers’ dig, pump, fish, pick materials from the earth and they pass through primary processing plants and through many convertors, distribution networks and retail outlets until they are sold to the final consumer. Traditionally we have preferred to work in batches pushing this material down the supply chain in huge piles, infrequently. Today we realise that this is wrong and we need to adopt a fundamental paradigm shift that only moves material down the supply chain as and when it is required by the next person in the chain and preferably on a continuous basis in small lots or ideally one at a time. In other words, the ideal product, in the future, will be made instantly, daily, with no waste and be consumed in the next process immediately. In most cases we are light years away from this ideal, but some industries, namely auto and electronic, are leading the way and showing us that this is possible as they desperately work towards this ideal.

This sounds like common sense and relatively easy, no so. There are many barriers to the implementation of good supply chain management best practices in our organisations, let’s look into a few of them.

Barriers to the implementation of supply chain management best practices.

We see four key barriers to the implementation of supply chain best practices:-

Seriously though, we are right!

If you analyse your company you will probably find more than 70% of your employees are working in your primary supply chain. So, they all need to be educated, maybe at different levels, but ultimately have some qualification, or professional certification, in this complex subject matter. People will only change if they can see the benefits and what-is-in-it-for-them.

More recently at conferences we have been hearing the term the ‘T’ shaped person. This means that we all have a great depth of knowledge in some part of the business which forms to vertical line of the ‘T’. So, if you are in Manufacturing, Distribution, Finance, HR, Procurement, Sales / Marketing, etc you should have a high level of expertise in that function, and may be certified from your professional body. In planning for example we would expect people to have their APICS CPIM (Certified in Production and Inventory Management) certification. But, this doesn’t give us an appreciation of the other roles in the organisation and the Supply Chain and how we should be working together cross functionally to promote best practice in our supply chains. The more recent certification program from APICS, CSCP, Certified Supply Chain Professional, gives anybody, wherever they work in the supply chain, a good indication of how a supply chain should operate and their role in the cross functional organisation. This provides the horizontal line on the ‘T’.

Without having ‘T’ shaped people in your organisations cross functional operations and supply chain management are going to be extremely difficult, if not impossible, to implement successfully. In reality, your most valuable asset is your people and you need to fill your organisation with highly educated, trained and empowered people to take you forward into a highly successful future. Finding these people and hiring from outside the organisation is difficult as there is a tremendous shortage of people with the right skills, we need to build within.

Well you have done the education and qualified people abound in your organisation itching to get started. Our advise is now to become a member of the Supply Chain Council and adopt the SCOR model as your framework for your supply chain management implementation. There are two 2 day workshops that show you how to make sense of, and use the SCOR model and how to implement it within your organisation and ultimately out to your suppliers and customer. All the hard work has been done for you, don’t re-invent the wheel just follow the model and implement.

The SCOR model looks at the attributes you are looking for in your supply chain, suggests the right processes and best practices to put in place at each point in your supply chain, and lastly what the correct metrics should be to promote the right behavior by your employees to achieve your supply chain objectives. It is almost a paint-by-numbers, no-brainer.

Well after implementing SCOR you will probably not have your supply chain working at its optimum, so after mapping the processes we need to determine where we have bottlenecks and apply the Theory of Constraints. More education is required at this point. Buy everybody a copy of ‘The Goal’ by Eli Goldratt, watch the video, and assemble your management team and work your way through the Eli Goldratt satellite video series. Eli puts forward some very controversial issues in this excellent series which can promote a great deal of useful discussion in your organisation.

To improve your supply chains, identify and eliminate waste in your processes then Lean, and all its tools, is the next education path on which to embark. APICS have put together an excellent Lean Enterprise Program, which the author has used several times, to build a Lean Team in your organisation which goes forth, conducts Kaizen events and spreads the word and education to others in the organisation. We believe that every manager and supervisor in your organisation should have the KPI of conducting at least four Kaizen events per year, one per quarter, in their departments.

All processes, whether in the factory or in the admin departments, have variation. This variation must be measured, understood and reduced. To assist us in this endeavour you need to investigate the concept of 6 Sigma. By adopting this philosophy you will be able to reduce variation in processes and thereby improve quality of your products and services. Measure the process, not the product!

All of the above will not work if you do not have a fully implemented successful, accurate and real-time ERP planning and control system within the organisation. Many of us have been sold an ERP system and it is not providing us with a competitive weapon out there in our supply chain. You need to have all the following working well within your organisation if you want to be successful in

In order to run a successful ERP system you will also need to focus on policies, procedures and computer work instructions on how this highly complex integrated system is run and managed. In addition, the correct metrics will need to be in place to ensure employees behave in the correct manner to support the objects of the organisation and of your supply chains. Use the Oliver Wight ABCD Check List to see how you measure up. You will need to be at least a “B” Class before you can consider moving into a successful supply chain management environment.

A lot of what supply chain management is about is trust. Far too many of us have adversarial relationships in our supply chains. We are in fact in lose-lose situations trying to put each other out of business instead of working together to find clever and innovative ways to reduce inventory, cost and lead times in out supply chains.

The procurement department should be spending 80% of it time on relationship building with its suppliers and collaboration rather than just placing orders. A Company is only going to be as good as its suppliers.

Our sales and marketing departments should be spending the majority of their time discussing demand and improving forecasting accuracy, rather than just taking the customer to lunch. Customer Relationship Management (CRM) and Supplier Relationship Management (SRM) are concepts that need to be embraced within an organisation.

The ultimate is to develop alliances in the supply chain where there is a great deal of trust and where costings can be shared and lead times and inventory reduced significantly in the supply chain with the savings being shared equitably by the supply chain partners.

The future is advanced planning and optimisation. Over the last few years the power of the computer is now allowing us to run the millions of scenarios to optimise our businesses to maximise profit and minimise cost. This is providing some companies with incredible benefits in their supply chains. However, you can’t just jump in and implement these tools without first having implemented your ERP system successfully.

MRP relies on accurate, real-time information to carry out its task effectively, advanced planning systems require a degree higher accuracy to enable them to do the job properly. Your ERP an MRP system plans materials and capacities on a sequential basis and when problems arise this sequential planning cycle needs to begin again from the top. Advanced Planning systems are able to plan the whole supply chain concurrently and in the next few years it will be possible to do this continuously on a real-time basis.

The concept of planning will then be a central operation, planning the complete supply chain, rather than having Demand Planning team, a Sales and Operations Planning team, a Master production Scheduler and Shop Floor Planners and Buyers performing planning functions, it will happen at a high level by one supply chain planning department.

So, in summary. You need to make your company a force to be reckoned in your Global Supply Chains and we need to make the South African manufacturing sector something to be admired in competing emerging markets.

So, Management it is up to you. We are relying on you to be one of our leaders with a supply chain vision, and to help you along here is a 10 point plan for guidance:-

Over the years, as consultants and educators, we have researched many companies as to why the promises of their ERP (Enterprise Resource Planning) software has never been realised. On investigation, and many assessments and analysis, the problem mostly lies, not with the software/hardware, but with the company’s employees, their knowledge and understanding of how to run and continuously improve their implemented ERP system.

One question we get asked when starting a new intervention with a company is, “We have ‘XYZ’ERP software, are you familiar with this product?” Our answer is that it is not necessary as the problem more than likely has nothing to do with the software. We have never found any ERP software that doesn’t work, generally the problem is a lack of management and the employees understanding of the integration of these highly complex systems. I usually liken this to giving somebody a car, which is also a highly complex integrated system, without the driving lessons that go with it. The result disaster, and it is the same with ERP. Understanding how to drive a car has nothing to do with which make of car you drive, the same with ERP, once you understand how to drive one ERP system, you should be able to drive any ERP system the company might decide to implement, or migrate to. Why don’t we have ERP ‘driving’ licenses? Maybe we do, we will discuss this later.

We have found eight aspects of any ERP implementation that are either done exceeding poorly or not even tackled at all, these are:-

There is not much in this list that relates to your software or hardware, except maybe the training aspect.

Hence, we have found that the formula for ERP success is equal to P3 + D2 + ETE. Let’s look at each of these eight aspects in more detail.

In essence, your ERP system plans and controls the major resources of your business, these being materials, machines, men and the money. Top management needs to dictate policy with regards to how these systems will function, this has to be done by physically writing policies for all aspects of the business. If this is not done employees at the lower levels in the organization will decide what they think is best for the business and plan and control the business accordingly. Worst still each function within the organisation could set ‘unwritten’ policy that suites their function but has a devastating effect on the rest of the organisation and ultimately on the whole supply chain.

As an example of the anarchy that can prevail, if there are no formal policies, can be illustrated by the company whose procurement department optimized their own function by having a ‘unwritten’ policy of buying material at less than standard cost so they would look good. This involved buying large quantities of cheap, low quality, raw material. This had the result of increasing storage costs and slowing the production equipment down to get the raw material to produce an often substandard finished product.

Policy, signed off by top management, needs to be written for many areas of the business. Over the years we have developed many of these policies which have been put into general terms and can be used as a starting point for the development of an effective set of policy documents. Without policy, it is difficult to develop processes and procedures that need to ultimately support these policies. Policies generally need to be written for, but not limited to, areas such as:-

These policies, once signed off my top management, will then guide the next aspect of your successful ERP implementation which is developing processes and procedures to support the above policies.

We understand that before we can improve a process the first thing we need to do is map the process and then analyse the steps prior to removing wasteful elements of the process and ultimately improving the process. In addition, let’s not discount the Supply Chain Council’s Supply Chain Operations Reference (SCOR) model. Here you will find high level best practice in most business planning and control processes. Find more information at www.supply-chain.org.

By mapping all the business processes, one can see how the whole planning and control ERP system will function at a high level and from these maps procedures can be developed that support best practice and the policies of the company. Include these process maps in your procedures it helps to clarify the procedure by using pictures as well as words.

The usefulness of mapping the process can be illustrated from the company that was not having much success with their quotation process. Sales reps were complaining that by the time they got the quote back to the customer, the order had already been placed with their competitor. The process was taking the best part of a week, whereas it should have not been longer than 24 hours. By simply mapping the process it could be seen how ridiculously the manual processes had expanded over the years such that everybody had visibility and input on the price prior to the quote being typed. By changing the process to include best practice and currently unused aspects of the ERP system it was possible to change the process to e-mail a quote to the customer within the 24 hour time frame and improved the quotation success rate.

Once the current processes have been mapped one then needs to determine best practice and map how you want the processes to work in the future and implement these changes. Once processes have been changed and documented in the procedures it is time to include how the procedure requires the use of the computer system.

The computer work instructions are sometimes included in the procedures but because they can be quite detailed with many ‘screen dumps’, it might be better to keep them in a separate document. These instructions need to be quite detailed to show employees exactly how to execute the computer processes and transactions correctly every time.

This complete set of documentation can then be used to educate, train and assess employee’s competence with regards to their processes. In fact it would form part of their ERP ‘driving’ license.

We find it strange that many employees we come across in a wide range of business are not measured or do not know how they are measured and hence whatever they do is fine!

Putting the correct performance measures or metrics in place is the only way to change people behavior. These metrics need to support the policy and strategy of the business, and again we can recommend the SCOR model which indicates the correct measures to put in place into each section of your supply chain in order to ensure you will support and achieve your supply chain strategy.

On occasions employees and functions have the wrong measure. Take the example of the electronics company that measured its production plant on the value it produced each month. So, when month end was approaching they looked at the value they had produced and if it was low they just manufactured high value items to look good at month end. However, what they where manufacturing was not necessarily what the customers wanted out in the market place. The correct measure in this case would be how well the plant produced the Master Production Schedule which should reflect the actual demand in the market place.

The hierarchy of measures that should to be put into place need to support each other and culminate with a few key measures that are reviewed by top management on a regular basis to ensure that the planning and control systems are functioning as they should.

If a key measure is not on the boss’s dashboard, employees don’t see that as important, as the boss doesn’t see it as important. This was illustrated by the company that were trying hard to get accuracy and real-time into their inventory records, but until the boss saw it as important and reviewed the measure on a regular basis it just didn’t happen down in the stores and warehouses.

To ensure that your ERP planning and control systems are running smoothly, Buker suggested, at least, the following 12 measures that should be reviewed by top management on a monthly basis:-

Many of these measures are aggregate measures and would need to be support by a lot more detailed measures at a lower level. For example, the overall inventory accuracy measure would be an aggregate of the inventory accuracy measures from many stores and warehouses within the organization.

Your ERP system thrives on data, it is its life blood. Your job is to make sure it is firstly there, accurate or relevant and real-time, where necessary. Inaccurate or missing data is probably one of the main reasons why ERP systems fail to reach their potential. Data is really boring stuff and hence we believe the reluctance to focus on it. Already by putting the above measures in place you have started making sure BOM’s, Routings and Inventory are accurate. But there is considerably more data in the system that needs to be addressed.

Firstly, it is our belief that an ERP system will not function if you do not have a Technical (Engineering) Change Committee (TCC/ECC) in place. The prime responsibility of this committee is to ensure that the Item Master, BOM’s and Routings are accurate and conform to the relevant policies. Processes and procedures will need to be put in place to ensure that this is a continuing process for ever and a day. In addition to the above, the following data also needs some focus to ensure accuracy and real-time:-

The last three file above are probably the easiest to get right as long as discipline is maintained on a daily basis, something we will talk about next. Every morning, those responsible for the above files, need to print their status report and with a highlighter and their first cup of coffee go through the report and highlight any orders that are ‘past due’. Then before 10am the new due dates for all these past due orders are change to the new date. This is essential for Materials Requirements Planning (MRP) to run properly.

We were asked to investigate why a company’s capacity planning system was suggesting that infinite capacity was need in the first period to satisfy the jobs on the factory floor. It didn’t take long to see that there were 3000+ shop order open on the factory floor the majority of them having been created and required in past due periods. These orders had never been completed on the system and closed. Hence the ERP system thought all these jobs still needed to be manufactured. Root cause, lack of an ERP ‘driving license’ for the shop floor scheduling personnel.

Your data needs to be like your bank account; absolutely 100% accurate and 100% real-time if people within your organisation want to be able to make sensible and accurate business decisions. Your system needs to reflect exactly what is happening in real-time compared to what is happening in the real world. Most of us use our ERP system as if we were driving down the highway making driving decisions by looking in the rear view mirror!

Discipline is something that, if put into place during an implementation, rapidly falls by the way side as time marches on if we are not careful. Part of the ERP ‘driving’ license needs to be education on the importance of keeping the discipline going. All employees need to continue with the documented processes, procedures and using the computer according to the work instructions at all times.

This we find doesn’t happen in practice because of various reasons:-

Lastly, we find employees have trouble persevering with the ERP technology and at some stage revert to manual processes outside the ERP system. Often this manifests itself in the ‘spreadsheet’ being used to try and replace a perfectly good integrated system that is not properly understood or is trying to use inaccurate, non-real-time data and continually providing the incorrect answers to the planning and control questions.

At a company with whom we had done a lot of work and who had reached the heights of being, if not a low “A” user of their ERP systems, then a very good “B”, had several management changes over the years. They didn’t keep up the education and training, discipline started to fall away as employees changed and moved jobs, performance measurements started to be dropped, portions of the system collapsed until they decided that the software was not working for them anymore and they bought another vendors system. They migrated a lot of rubbish from the old system to the new system and ended up with even less than they had before. It will take years for this company to get back to where they were and it is such a pity after all the hard work they put in to get where they were in the first place.

Why not have your ERP systems externally audited on an annual basis to ensure they are still functioning as designed and get recommendation to improve the systems and utilise more of the existing, or new technology, which is continually coming along. Many of us buy, or get sold, ERP systems but only end up using a very small percentage of the technology available to us, for which we have generally paid handsomely. Here we would suggest you refer ‘The Oliver Wight Class ‘A’ Checklist for Business Excellence’ book obtainable for their website www.oliverwight.com.

This should really be the first term in the formula for success, because without this element of the equation nothing else is going to function correctly. This forms the foundation for the ERP ‘driving’ License and without this most employees haven’t the first idea how their systems function, integrate and work the way they should. Using our automobile analogy, the software vendor is the car salesman, but it is the driving school, APICS/SAPICS, that provide the education to enable people to generically operate these systems successfully.

Some time ago we were asked to assist a heavy engineering company in finding some new ERP software as they were unhappy with their current system, which they had had for 5 years. They were using probably one of the most popular ERP systems at the time in South Africa, but it didn’t function for them and they were looking to spend million of Rands implementing a new one. We said, before you throw money at the symptom, let’s look for the root cause as to why your current system is not functioning for you. We spend a couple of days having a look at the situation and quickly realised that they had not structured the BOM’s in the way that they build the product but in the way they prepare the engineering drawings. The draughtsmen were in charge of the BOM’s and there was no BOM or Technical Change Committee policy!

We explained the situation to them, gave them one days education on structuring BOM’s, spend another day generically restructuring one of their major products and today, more than 10 years later, they are still using the same ERP system successfully. So for the sake of one day’s education they suffered 5 years of heartache unnecessarily. And, as a bonus they didn’t have to spend millions on implementing a new system. Their question was, “Why didn’t we know this when we initially implemented the system?” And the answer was there was nobody in the organisation with the necessary knowledge and an ERP ‘driving license’ to lead the way.

SAPICS and APICS, and their network of Authorised Education Providers (AEP’s) around the country have all the programs, courses and certification programs that you will need to get your employees ‘up-to-scratch’ with best practice in operations and supply chain management. You have paid for this education through your skills development levy, surely it makes sense to start getting something back for your money that can provide the company with a benefit!

OK, so again using our automobile analogy, we have bought ‘the car’, and we have had the ‘driving lessons’, it is now time to get trained on the particular ‘model’ that we have purchased. This is where your software vendor comes in. We have had our policies signed off by management and our best practices have been mapped, it is now time to implement them in the software we have purchased.

The important thing with regards to software training is that everybody should get first hand training from the vendor and not secondhand training from a colleague that has been on the course. If you attend a training course it is likely that you will retain 20% of what you have been taught. If you pass this 20% onto your colleague they are likely to retain only 4%! If a new employee takes over this process and retains 20% of the 4%, well basically they know nothing, and particularly if they have no ERP education, one can see how quickly systems can deteriorate and begin to fall over.

Education and training needs to be continuous and never ending, we can always learn something new. One client said, “Every time I educate and train people, they leave.” Our retort was, “What happens if you don’t educate and train them and they decide to stay!” The secret is to provide an environment in which people want to stay, work and develop.

When it comes to ERP systems continual improvement, employee empowerment is the crux, and if you are not continually improving, adding to or taking advantage of the latest technology, your systems are in reality going backwards. You need to stay ahead of your competition in providing the best possible service to you customers, can you imagine an international courier company staying in business if they don’t have a consignment tracking website, it is now an order qualifier, rather than an order winner.

With the right basic ERP education, operations and supply chain qualifications or certification from APICS, together with the first hand software training from your vendor it is now time to empower you employees to go out and make a difference by continually improving the systems, by leaning the processes and reducing the waste in you systems. Some more education in JIT/Lean, TQM, Kaizen events and Six Sigma can help you considerably here and again SAPICS/APICS has programs to assist you in these endeavors’. In essence, as operations and supply chain knowledge is growing exponentially a culture of continually learning has to be a policy of the company, from the very top down to the bottom of the organisation. We all need to be learning something new all of the time, just to keep pace with developments.

Recently, at a local packaging company, after running an in-house APICS Lean program for a team of their employees, they carried out some 3 day Kaizen events where set-up times on a number of their machines were reduce by between 50% – 75%, virtually at no cost. We should all be doing this, all the time, with all our processes! Start tomorrow.

So, in summary, pretty well most of what we have discussed above has really not much to do with what ERP software you are running, it is all pretty software independent, hence the title of this paper.

Why don’t companies develop an ‘ERP ‘Driving’ License for their employees and dictate in their policy that employees will need to have certain levels of generic education, qualifications, certification, software training and be assessed as competent in the processes in which they are involved.

Just to highlight the eight areas again that we believe need continual focus when it comes to the success of your ERP system:-

We could spend a good day or so on each of these aspect above, here we have just been able to scratch the surface. If you are not sure how to tackle to points above, find an operations or supply chain consultant that can set you off on the right road.

In addition, we have attached a checklist which covers the above points, just see how you rate, and then put an action plan in place to improve …. continuously.

Generating a statistical forecast, by what ever means, is not the same as creating a consensus demand plan in your business, it is only the first part of a four part process.

Over the last fifteen years I have visited and worked with about 150 companies. One of the first questions asked is often “What is your budget for Demand Management in the business?” The response is often surprise as to the need for one and comments like, the salesmen are responsible for forecasts and they ‘suck-their-thumbs’ for half an hour at the end of the month, where is the need for a budget? It is amazing how many companies run their whole business based on a salesman’s thumb suck!

Demand management and coming up with a reasonable demand plan, is a key process in any business. If you don’t have a reasonable idea of all the demands on your business into the future, how on earth are you going to be able to plan the supply of resources in the form of materials, capacity and labour?

A business requires the best forecast it can for various reasons, including:

Most businesses are still using judgemental or intuitive forecasting techniques where as they should be using more scientific methods. Forecasts can also get mixed up with goal setting and become the yardstick by which salesmen are measured. Hence, the reluctance of the salesmen to be involved in the process as, due to the first rule of forecasting, they will always be wrong. The advantage of putting a consensus demand management process in place is that it separates the forecasting process from goal setting. Forecasting than becomes systemic and objective.

Some of the common forecasting myths, mainly resulting from a lack of understanding and education, are:

Some of the common gripes one comes across, mainly from the sales team, are:

And in operations, we are the victims of a lousy forecast and there is nothing we can do about it.

Forecasting is the wide science of prediction. Some events are very predicable, sun rise and sunset, tides, etc. Others are less predictable, such as weather forecasting and stock prices. Others are totally unpredictable such as the lottery. However, modern forecasting techniques can assist us forecasting more accurately than before for events that have some pattern to them or are being driven by some external forces.

So, business forecasting is the first step in the business planning process and a major part of the demand management process. It is the prediction of the sales of a company’s independent demand such as finished products and spare parts that are for sale. These forecasts need to be aggregated to satisfy the three basic levels of planning in a business:

Strategic planning is predicting the overall market and direction of the economy over the next three to five years. It provides a plan for those things that take a long time to change such as major plant expansions and new product introductions. Forecasts are usually in monetary terms and are reviewed annually.

Sales and Operations Planning is concerned with manufacturing activity over the next year or two. Forecasts are generally made for groups of items centred on manufacturing facilities or production lines. The purpose is to determine when the company needs to significantly change its capacity. These forecasts are reviewed monthly.

Master Production Scheduling is concerned with manufacturing activity for the next four to six months, or the planning horizon based on the cumulative lead time to buy raw materials and manufacture the product. Detailed forecasts need to be made for each individual finished product. The purpose is to be able to use this master schedule to calculate, using BOMs and MRP, raw material and component requirements out into the future. The important thing to remember is that the three forecasts above need to be built from the same data in order for them to support each other.

What are the objectives and output of the demand management process?

The primary objective of the demand management process is to provide the business with a reasonable demand plan with which to drive the business planning processes. This will assist the company to better plan investment strategy, plan new resources and plant into the future and plan the procurement for long lead-time materials, timeously.

These three demand plans need to be derived from the same data, support each other and be a consensus of those with insight into the business. These plans can’t be developed independently by different people or teams in the organisation or be one persons or groups thoughts on what is going to happen into the future. When the demand plan is proved to be wrong, which it will be, we don’t want to blame a person or group. Instead, we ask the question “why?” and file the answer away in our ‘knowledge bank’ and change the process to improve the accuracy of the output.

Consensus demand management is the process of gaining a reasonable grasp of all the demands on the business. This process needs to be the responsibility of the demand team which should consist of at least the following functions:

The demand management process consists of four basic steps:

Step one is for the demand manager to prepare the detailed statistical forecasts using computerised tools. These are then communicated to the sales team for collaboration with the customers. These collaborated forecasts are then fed back to the demand team for the qualitative forecasting process and the creation of the three demand plans for the planning processes.

Let’s look at each of these four basic steps in more detail.

Prior to this process it is important that there is an ‘actual’ demand file used to generate the forecasts. Extracting your sales history from your ERP system does not exactly give you a statement of actual demand in the past. Differences between the sales history and actual demand can be caused for the following reasons:

The sales history file needs to be ‘massaged’ into the demand file suitable for statistical forecasting to take place. This file should then be saved separately from the sales history. Each month the demand file is then appended with the latest months sales figures and ‘massaged’ where necessary prior to forecasting taking place.

Quantitative statistical forecasting techniques come in two forms; intrinsic and extrinsic. Intrinsic techniques only use the company’s internal data, basically the sales history / demand file, to prepare a forecast. Extrinsic techniques, not only use the company’s data, but other data from external sources to the company.

Intrinsic techniques include:

Extrinsic techniques include:

Most focussed forecasting computerised systems will suggest or select the best intrinsic technique to give the least error, based on the demand file data. The forecasting systems don’t understand the product which is being forecasted, all they are doing is taking your time series and looking for patterns, trends, cycles, events and seasonality in the data and then projecting these out into the future.

In order to pick up these time series characteristics, at least two years of data is required. More data can also be useful, but you need to ask yourself, how relevant are the sales of five years ago, for a product, compared to today?

The moving average and single exponential smoothing techniques are only really useful for non-trended and non seasonal data. Holts method will start looking for trends, whereas Winters, Box Jenkins and ARIMA models will detect and predict seasonality.

Croston’s intermittent model is used mainly for parts that are sold infrequently, such as spare parts, it attempts to determine in which periods parts will be sold and how many.

Curve fitting is not really a forecasting technique, but it can be useful in looking at overall trends with regards to data. Trends can be normally fitted to a number of different curves such as straight lines, damped, exponential as well as ‘S’ shaped life cycle curves. Leading indicators can be useful in improving business forecasts. Ideally, you need to find some external data that correlates with the internal company data and can be used as a leading indicator with regards to change in the demand for a product. For example, the pattern of sales for motor car tyres will be preceded by the sales of petrol and diesel.

When abnormal demand, both high and low, is experienced the reason for these events needs to be flagged. If the company uses promotions to promote its products this can be flagged as an event and promotions indicated in the future will try and predict sales in these periods based on promotions of the past.

Dynamic regression is probably the ultimate in forecasting techniques which uses both intrinsic and correlating extrinsic data to build a model that increases the accuracy of forecasting a product.

Once the forecasts have been generated, the next step in the process is to collaborate with the customers with regards to the statistically projected demand.

Statistical forecasts are purely a projection of the past. We all know that the future is rarely a repetition of the past and so we need to look at how the future could change.

Most customers don’t have too much of an idea as to what their demand is going to be into the future. By presenting the customer with the statistical forecast of their products in a graphical format can go a long way to starting the collaborative discussions into future demand. Here the problem is one of time. Most companies have hundreds of customers / products and the time to collaborate on all these is prohibitive. The answer is to perform an ‘ABC’ analysis on your products / customers and focus on the 20% that gave you about 80% of your sales. The 80% of the balance you should leave up to the forecasting system to predict the future. If you can get 80% of your demand reasonably right this should be sufficient to greatly improving your overall forecast accuracy.

The statistical forecasts can then be updated based on the customer input and then fed back to the demand team for the next step of the process.

The qualitative process looks at all the external environmental factors that affect your business over which you have absolutely no control. You need to understand how each of these factors positively, or negatively, affects the demand on your business.

What external factors affect your business?

Ideally, we need to try and determine a mathematical relationship between these factors and the company’s sales. For example, for every 1% increase in the birth rate you could expect a 0.5% increase in sales.

More formally, the qualitative process can be made up of five techniques:

The Delphi technique involves assembling a small team of people who, independently, are asked questions the answers to which are then circulated to the rest of the team. The process is repeated four to six times after which some sort of consensus is obtained from the team with regards to the purpose of the questions.

Market surveys are usually carried out by companies that market to the final consumer. They take the form of test panels, questionnaires, test markets or surveys. The primary purpose is to gather data on market conditions and perceptions.

It is difficult to forecast a new product or brand as there is no sales history on which to base the projections. In this case companies often use an historical analogy of a similar product introduced previously.

Life cycle analysis helps us to modify the forecasts depending on where your product or technology is in its life cycle. A product that has just been launched will predict lower sales than one would expect as the product moves into the growth phase. As the products life cycle is coming to an end the forecast will predict higher sales than can expected as the product slowly dies.

Informed judgement is a process that uses no rigorous methodology, but consists of a group of people, such as the demand team, using their experience, hunches and some facts about the situation to come up with a consensus on any situation.

Because intrinsic quantitative statistical forecasting only looks at current products from current customer, the qualitative process needs to factor in any expected demand from new customers and new products that will create demand into the future. This process is fairly complicated and will need to be developed and maintained by the demand team.

The last part of the process is now for the demand team to come up with the best demand plan possible that will be used to drive the business.

Once the process of generating the quantitative forecast, the collaboration with the customer and the qualitative process has taken place, it is time to generate the three demand plans.

The last part of the process could be summarised in the following ten points:

It is no good just generating the forecast and then forgetting about them, the key to forecast accuracy improvement is through forecast accuracy measurement.

There are many techniques for measuring forecast error, here are some of them:

Probably the one technique used by most Materials and Supply Chain Managers is the simplest one to understand and that is the MAD. The MAD can also be used to calculate safety stock levels and the tracking signal.

The ‘M’ implies the average error, the ‘A’ is for absolute which means ignore the sign, over or under forecasting are just as bad as each other, ‘D’ is for deviation and looks at the difference between the actual sales and forecast. In other words the error.

The MAD is calculated by summing the monthly absolute differences between sales and forecast and dividing by the number of months in the time series, as per the following example:

In the above example the MAD would be the sum of the absolute errors, 24, divided by the number of monthly periods, 6, giving us the answer 4. In other words, on average, the forecasts for this item have a plus / minus 4 error. This gives us a feeling for items forecast accuracy.

The tracking signal is used to measure the quality of the forecast. It also indicates when a change of forecasting technique or parameters is needed, as well as indicating bias in your forecasts. If you have bias in your forecasts this is the first thing that needs to be eliminated. Continually over, or under, forecasting is very bad; you need to be over some months and under others, hovering around the zero line.

The tracking signal is calculated by taking the algebraic sum of the errors and dividing by the MAD. If the tracking signal remains in the band +4 to -4, then the forecasting system is providing a reasonable result. Outside this band, it is suggested that a change of forecasting technique or parameters in made. Let’s look at the following example

If we plot the tracking signal each month on the graph below we can determine a few things:

In summary, this paper has suggested a methodology that companies could adopt in developing a consensus demand plan for their business. If we have a reasonable idea of the demand on our business we have a better chance of organising the supply to satisfy the customer requirements.

The demand management process indicated above can be summarised as follows:

The above should assist you in providing even higher levels of service to your customers than in the past, which will result in more business and higher profits.

Over the last thirteen years the author has worked with over 120 manufacturing companies in Southern Africa.

This work has involved consulting and education in materials, manufacturing and supply chain management. Many manufacturing, planning and control system assessments have been conducted with these companies to ascertain the company’s ability to use their Enterprise Resource Planning (ERP) systems effectively and almost without fail the following twelve reasons for poor implementations crop up every time.

This paper briefly looks at these twelve reasons for poor ERP implementations in the hope that future implementations or re-implementations will take these issues into account.

There will not be sufficient time to go into each of these areas of concern in detail, but the hope is that companies will recognise the mistakes that have been made in the past and put plans into place to rectify these problematic situations. Any re-implementation of their systems should then result in them developing an ERP system that will provide them with a competitive weapon out there in the global marketplace.

Many times the software vendor will take on the responsibility for the implementation project for their software. This happens generally because the company wanting the implementation have no, or very little, understanding of manufacturing systems or the resources or expertise to conduct the project management process. Unfortunately, the objectives of the software vendor and the company requiring the systems are not always the same.

The software customer is looking for a fully implemented, accurate, real-time planning and control system that will give them a competitive edge out in their market place. On the other hand, the software vendor wants to load software, conduct some training, go-live and invoice for their services. In practice, these two objectives can be poles apart.

It is important that the company requiring the systems manage their own project and progress at a pace that suites them. They then need to employ software consultants, manufacturing consultants and educators to ultimately provide them with a complete solution that operates to their satisfaction. If any of the consultants or educators / trainers are not providing the service required they can then be replaced.

The company requiring the implementation therefore needs to take responsibility for the outcome of the project and not blame the software vendor when the systems do not work out according to their requirements, which can often be the case. In the worst case that we have come across, software vendors agreed to supply and implement systems in a food processing company. They dropped hardware, loaded software, partially trained one person, who left shortly afterwards and left the company with a system that nobody knew how to even switch on and an invoice for implementation. The company refused to pay and several expensive years later with lawyers and courts, a settlement was made. But the company still doesn’t have a system. They have been persuaded to take control of their own destiny next time and do the job properly.

One thing that really needs to be understood with an ERP implementation, it is not an Information Technology (IT) project, it is a people’s project. The IT is just a tool to manage the data and to perform the long drawn out calculations required by these systems.

If a company had one finished product and six raw materials, their whole ERP system could be managed on a piece of paper. Because we generally have hundreds of finished products and possibly thousands of raw materials the task is too complex to commit to paper and a tool is required to handle the data storage and calculations, hence your ERP system.

Consequently, never put the IT department in charge of a manufacturing systems implementation project. The project needs to be run by people from operations or the supply chain. IT people will focus on the hardware and software, whereas we need to focus on the people, their understanding, education, training and empowerment to run the systems such as to harness a competitive advantage in the supply chain. The successful implementation of ERP is therefore more about people and change management, than loading software onto a computer.

As mentioned earlier the implementation project needs to be run by the manufacturing company and the project needs to be organised in a professional manner for it to succeed. ERP implementations require a project sponsor, who is generally the Boss / MD / CEO who needs to be actively involved in the project on a daily basis. The project requires a steering committee, which is generally the top management team of the company, or it should include the leader of each of the task teams mentioned below, if they are not part of the top management team. This committee should also include a software supplier representative and the manufacturing consultant / educator.

A full time project leader is essential. From my own experience, if the project leader has other duties in the organisation, the customer always comes first and the project takes a back seat position. To implement an ERP system requires a companywide approach and therefore the users across the company need to be fully involved. The project needs to be broken down into areas that also need to be integrated and coordinated by the project leader. In implementations of this type certain things need to take place before others can be tackled. For example you cannot create bills of materials until all the items have been defined in the item master and you cannot start cost roll-ups until the bills of materials and routing have been developed and audited.

Task teams can vary from company to company, but generally they fall into the following areas, with the following responsibilities:

There should be a monthly steering committee meeting to ensure that plans are on track, to resolve any conflict between different task teams and to ensure there are sufficient resources to complete the project on time. Task teams should meet weekly to review progress and to ensure that their more detailed plans are on track. These are the people that will actually do the implementation, collect and audit the data required.

The project leader should attend all these meeting and in between assist where he can to ensure the project is completed on time. He will also liaise with software and manufacturing consultants and educators to coordinate training and education requirements.

The above project structure will need to develop an overall implementation plan as well as detailed task force team plans that will integrate into the overall project plan. A budget will also need to be developed which will include items such as:

These plans and budgets will need to be reviewed monthly at the steering committee meetings and updated as and when required. Don’t be too optimistic with the implementation time horizon of your project, it always takes longer than you think to implement these systems because you are dealing with people, people that have their daily jobs to do as well as implementing the new system.

When it comes to budget cutting be warned not to cut education and training otherwise you will surely fail as we mention below. A poor or failed implementation will cost you 90% of a successful one, but you will only realise 10% of the benefits as opposed to 90% plus.

Demand management is a primary process for any manufacturing business and one that we have found is carried out extremely poorly. Huge businesses are run on a salesman’s ‘thumb suck’. Most businesses visited don’t have a budget or process for demand management and hence spend their time being very reactive and continually expediting as the customers try to drive the business.

If you don’t have a ‘reasonable’ handle on the demand for your business, how on earth are you going to plan an ‘acceptable’ supply to support the high levels of customer service required by modern supply chains? Forecasting and demand management is too important to leave to the salesman. Demand management is a process that includes those persons in the business that have insight into those external situations that seriously affect the performance of the business. These can include such things as Forex rates, oil or other commodity prices, interest rates, weather, terrorist activity, international political situations, etc, the list can be endless.

The demand management process begins with statistical forecasting which tries to find patterns, trends, cycles and seasonality in your sales data and then project these characteristics into the future. This data is then reviewed by sales and marketing and adjusted to include the latest customer information. Lastly, qualitative processes are used by the demand management team to come up with a consensus demand plan that can be used to drive the business.

When the demand plan is not 100% correct, which it will not be, we don’t blame the salesman, we blame the process and find ways of improving the accuracy of the process over time.

This is really the first and most important planning process in an ERP process and yet one that is rarely tackled by top management, possibly because most ERP software offerings don’t include a module for this process. Most of our clients successfully use spreadsheet systems integrated into their ERP system to perform this top level planning hierarchy process.

This is where top management get involved in ERP by providing an authorised ‘Game Plan’ to the rest of the employees to enable them to carry out their tasks but at the same time they are supporting the strategy of the business. It is at this level that the manufacturing strategy is developed, inventory levels are determined and sales and production levels are set to support the company’s customers. This is how the ‘Boss’ guides the business and he will be checking on a daily basis from feedback that his plan is on track. If exceptions are detected they can be dealt with immediately so that the company can realise its objectives in the long term.

The other important purpose of the S&OP is to determine when the company will need to significantly change its capacity, allowing sufficient lead time to accomplish an increase to support future demand.

Of all the companies visited over the last decade, or more, we would say virtually none have had anybody we would really truly class as a Master Production Scheduler. Mostly when enquiring about a company's Master Scheduler we are directed to a clerk sitting at the back of the factory reporting to production. This is not a Master Scheduler and at best could be called a shop floor scheduler.

The Master Scheduler is the ‘helmsman of your ship’; if you have a bad helmsman you will be on the rocks passing Robben Island! The Master Scheduler creates the anticipated build schedule for your business that is a statement of how the company plans to supply the demand on the business. The Master Scheduler will ensure that customer service levels are maintained. Except for perhaps the boss, your Master Scheduler is probably the most important person in your business and if not reporting to a supply chain manager should report directly to the boss.

This Master Schedule then becomes a set of planning numbers that drives the Materials Requirements Planning (MRP) system rather than the customers and salesmen driving the business through forecasts and customer orders.

How many companies have bought, or been sold, an ERP system and have never got around to using the MRP system which is surely why they bought it in the first place - to enable to plan and control their materials and capacities. Those companies that have got around to pressing that button marked MRP in their software generally have such poor quality input data that planners and buyers abandon the inaccurate output and revert to their ‘trusty’ old spreadsheets as they still need to determine what needs to be purchased / manufactured, how many and when.

The previous point with regards to MRP leads me straight into this problem area, database and information accuracy. What databases and information should be accurate and just as importantly realtime? Well the simple answer is everything! But for your planning and control systems to function the following are the important ones to concentrate on:

Order files, all three of them, need to be accurate with regards item number on order, quantity and the due date. MRP systems can’t handle ‘past due’ dates, it seriously affects the requirements calculations. Inventory records not only need to be audited above 95% accuracy using proper cycle counting processes, but also as real-time as possible, like your bank account!

Item master planning information, such as order policy, order quantities, lead times, safety stock and safety lead time data needs to be there, appropriate or reasonable for the planning system to function with any degree of effectiveness. Bills of materials and routings need to be audited to high levels of accuracy to allow the planning systems to determine correct material and capacity requirements. How we achieve the required levels of accuracy in these files is tackled under the next heading.

In our humble opinion and this has been born out in practice, an ERP system can never be sustained into the future if the company does not have a technical change committee (TCC) to create, maintain and audit the three key manufacturing databases; item master, bills of materials and routings.

The item master is particularly difficult to manage as it relies on many persons in the company to provide the data that it contains. A policy needs to be written determining what fields in the item master will be used for what, what information would we expect to find in that field and most important of all, who is responsible for that data.

The bills of materials (BOMs) determine the structure, materials and components that are used to build the product. The BOMs have many uses and users in a manufacturing business and again a policy needs to be developed determining how you will structure your BOMs and what will be included and what will not be included in the BOM. BOMs need to be audited, against this policy, to accuracy levels of 98% plus correct prior to them being used to generate material requirements through the MRP system.

Routings are used in the ERP system to perform capacity planning and scheduling and again there needs to be a policy against which they can be audited to greater than 95% accuracy prior to being used for these purposes. This committee should have representation from Sales, Production, Costing, QC, Purchasing, Materials,

Planning, etc, as any small change to a product or material could affect each of these departments differently and consensus needs to be obtained on any change proposed or made. The TCC will also be responsible for new product introductions and changes to existing products to ensure that the implementation of the change is handled correctly and that the databases are updated correctly and timeously.

This is usually the part of an implementation that gets forgotten and unless this section and the next two are implemented properly the systems will never be sustainable into the long term. Documentation needs to be written at three levels; policies, procedures and computer work instructions.